This article was originally published on Medium*.

Synthesize the complex web of financial strategies, regulations, and trends with a personalized financial advice RAG-based chatbot.

The financial services industry faces a challenge in balancing personalization and scale as customer expectations for timely, relevant, and customized financial advice continue to rise. Traditional solutions may struggle to meet these demands due to the complexity and rapid evolution of financial data and regulations. A RAG solution can significantly enhance financial advice by providing real-time access to up-to-date regulatory, market, and financial product data and synthesizing it into actionable advice for users.

However, due to the low fault-tolerance in finance, the use of nondeterministic methods such as neural networks must be carefully evaluated. Solution developers should consider fine-tuning in addition to RAG to increase alignment and reduce the risk of hallucinations.

When are Fine-tuning and RAG Appropriate?

RAG applications generally aim to reduce the need for fine-tuning of base models. Still, certain high-stakes sectors, like financial services and healthcare, might require extra model alignment with fine-tuning on a comprehensive knowledge base. The necessity of fine-tuning and RAG depends on the specific use case, available resources, necessary customer knowledge, and desired custom behavior. The appropriate balance ensures accurate, reliable, and tailored AI-driven advice.

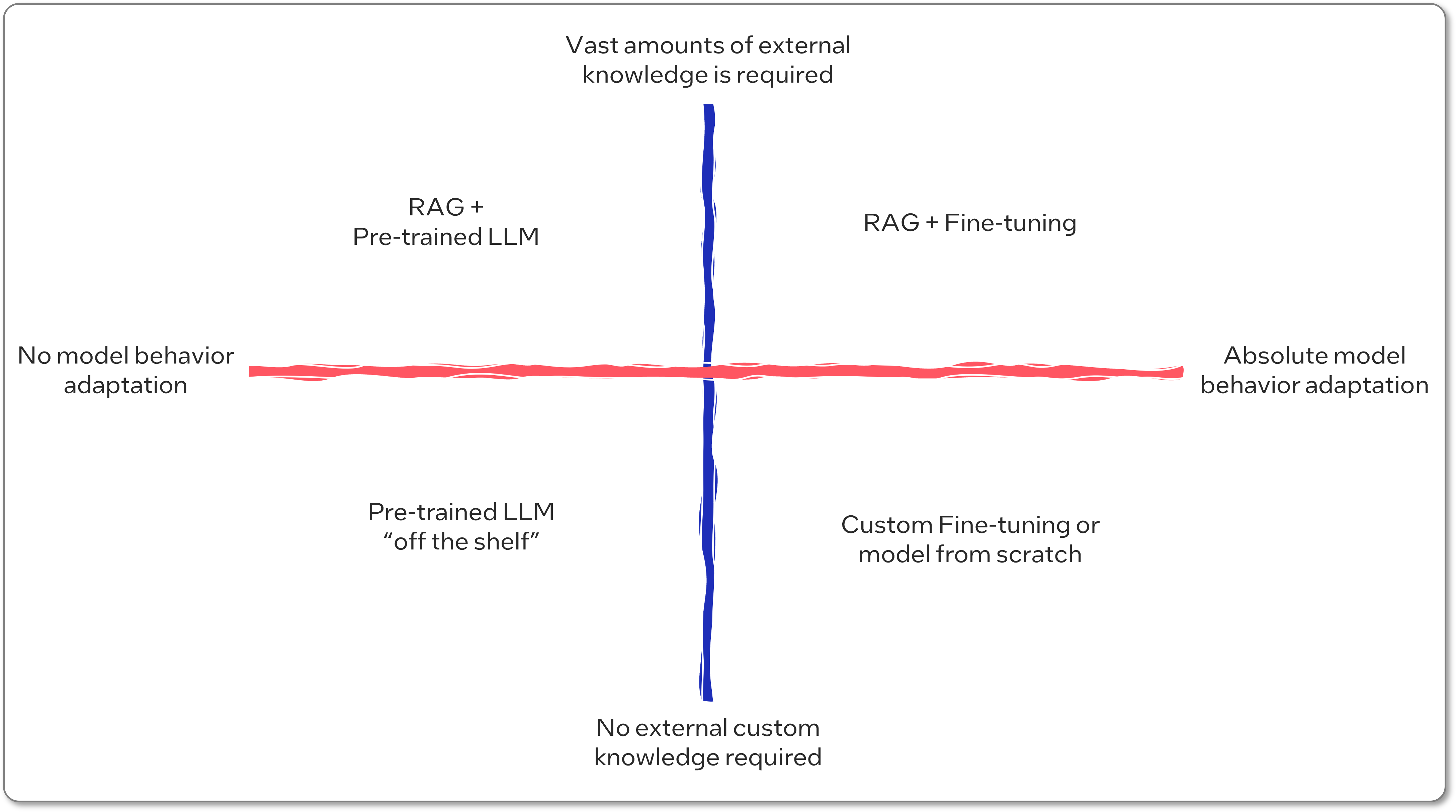

The following figure (see figure 1) provides a simplified decision-making framework to help assess these factors.

Figure 1. The diagram provides a simple framework for defining when RAG and pretrained large language model (LLM) are sufficient, if RAG and fine-tuning are required, if a pretrained LLM without RAG will work, or if a model must be trained from scratch or fine-tuned from a foundational model and used without RAG.

RAG-Powered Financial Advice Chatbots

Financial institutions face the challenge of delivering high-quality, personalized financial advice to a large customer base while dealing with the continuous flux of financial data and an intricate regulatory landscape. This complex environment requires solutions that meet the growing demands and expectations of customers.

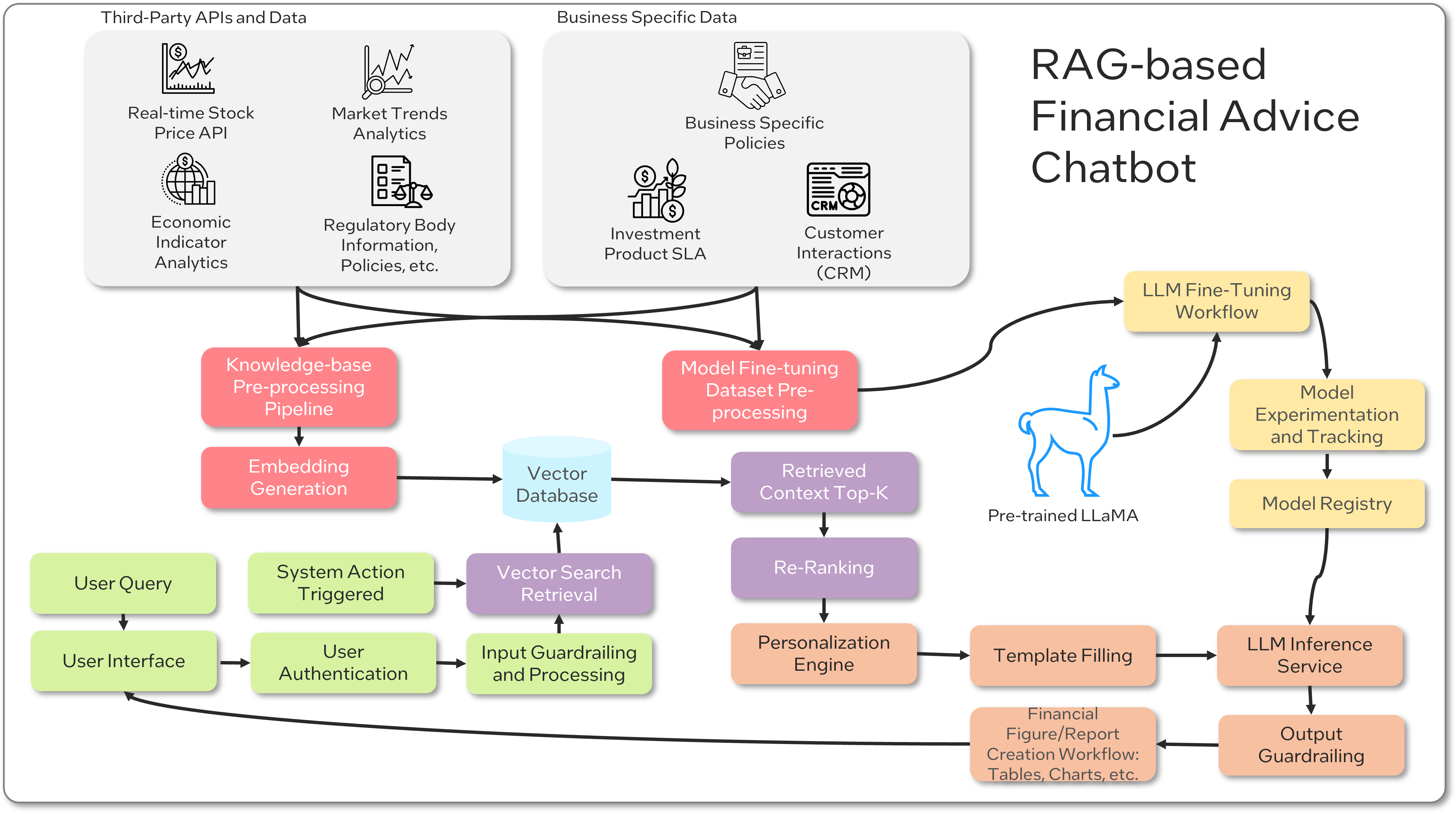

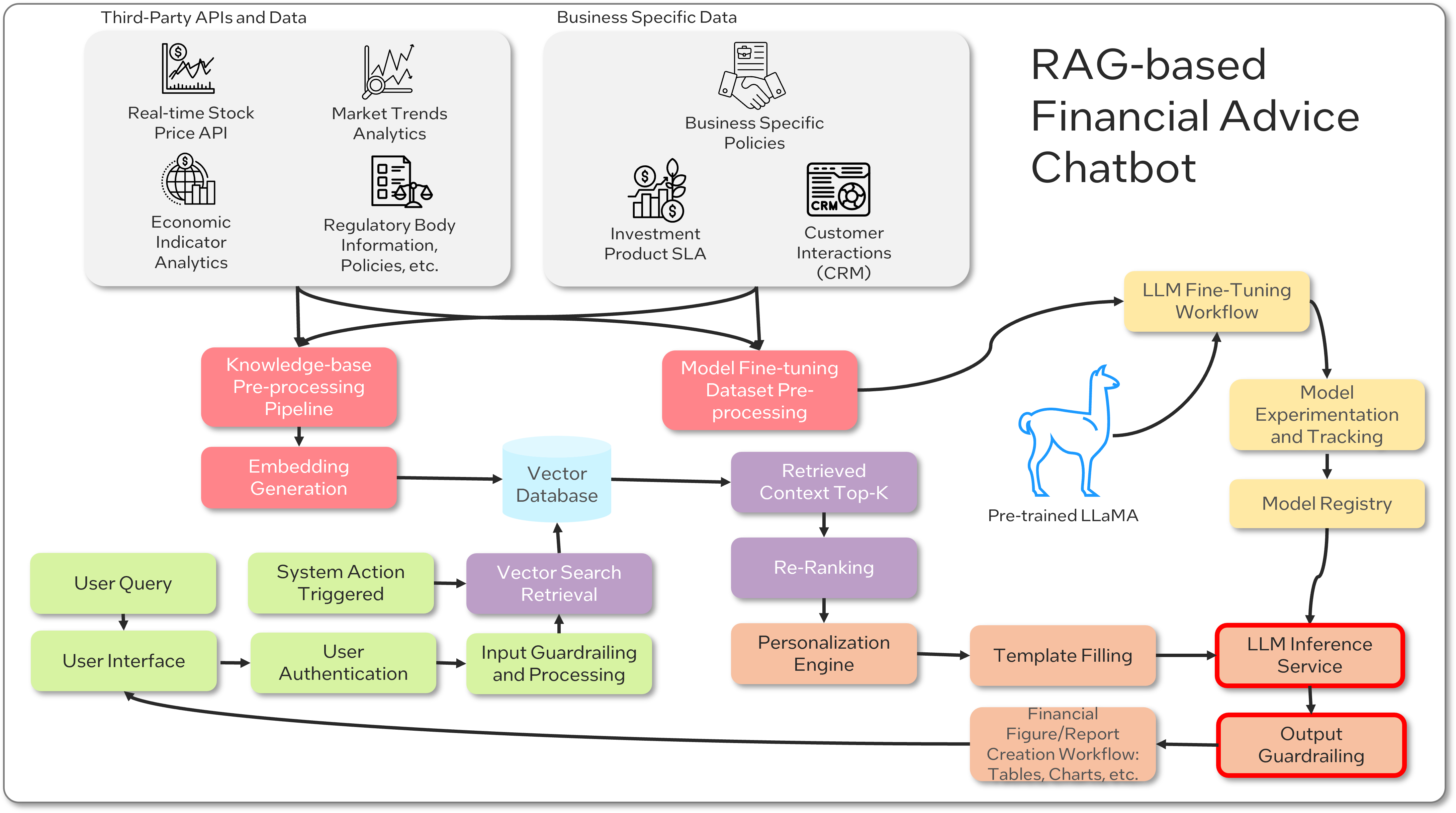

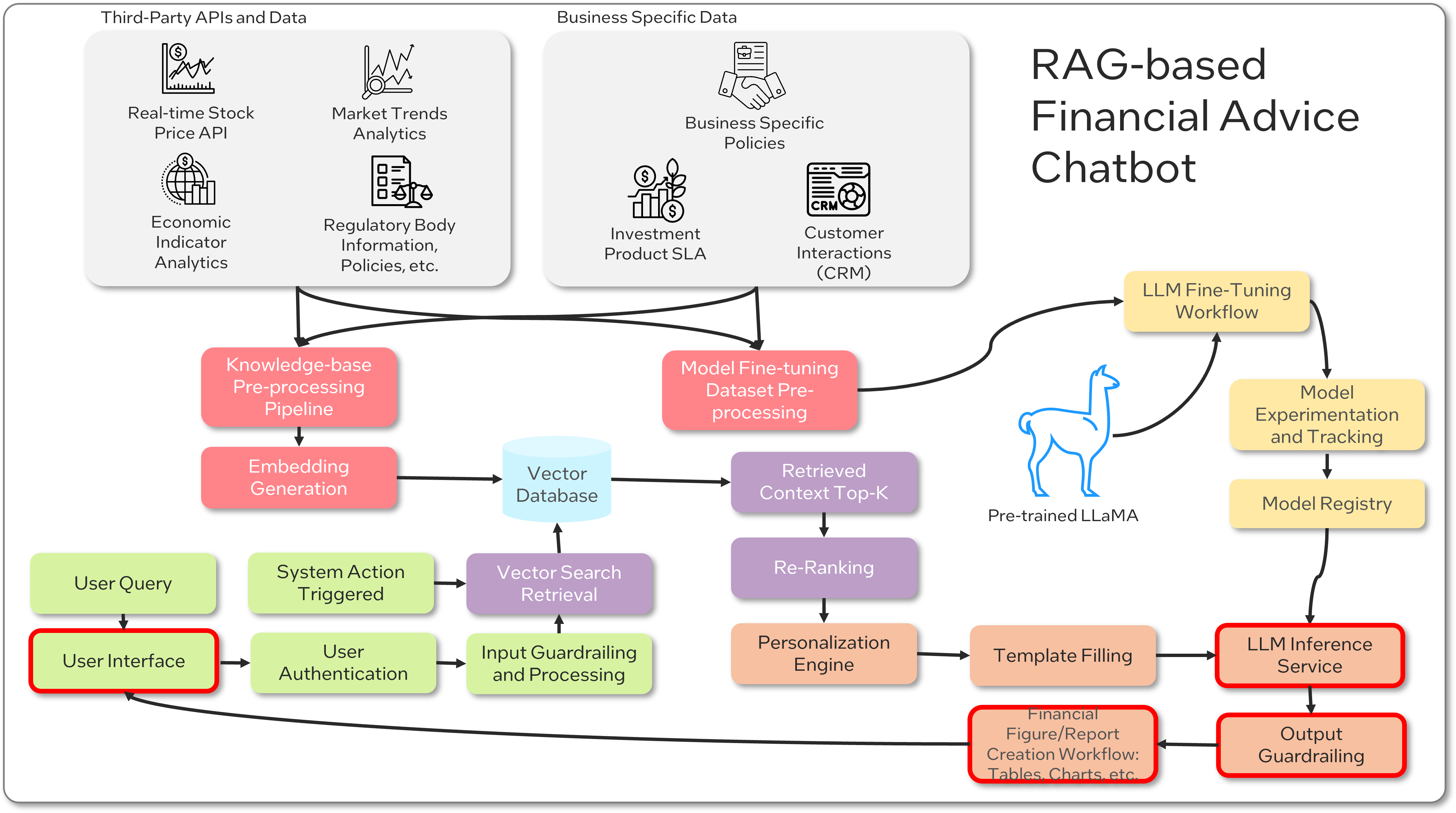

A RAG-powered financial advice chatbot can help tackle these challenges by using real-time access to current financial data and regulations. Here, we present a solution architecture and a high-level overview of this approach (see figure 2).

Figure 2. RAG-based financial advice chatbot system architecture

In addressing the low fault tolerance of the financial application, a foundational model is fine-tuned using relevant financial data and stored in a model registry for RAG pipeline use. The knowledge base for fine-tuning and RAG consists of data from third-party APIs and business-specific elements, processed and embedded for vector database construction. Upon user-query or system automation, the relevant context is retrieved, reranked, and personalized, and then passed to the large language model (LLM) inference service, using the fine-tuned finance LLM. The guardrailed LLM output is then used in a financial figure and report generation process, with the final output delivered to the user through the interface, ensuring precise, context-aware, and secure financial advice.

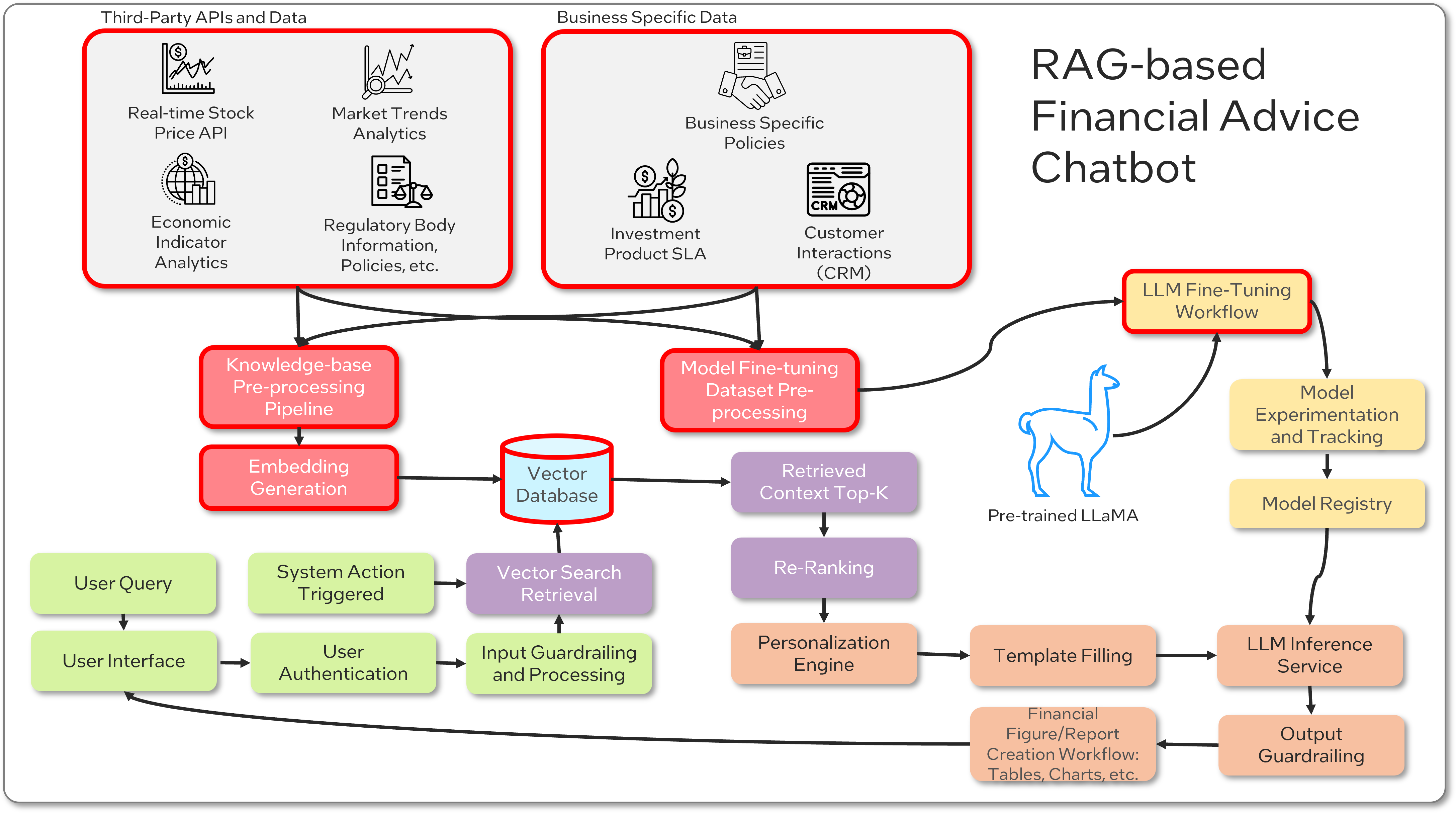

Build a Custom Knowledge Base

At the core of this RAG-enhanced chatbot is a custom knowledge base that integrates third-party and proprietary business data (see figure 3). This knowledge base informs both the data retrieval mechanisms and the fine-tuning of the chatbot’s LLM, ensuring the delivery of advice that’s accurate, relevant, and in-line with the latest financial regulations.

Figure 3. Highlighting the custom knowledge base layer of the solution architecture

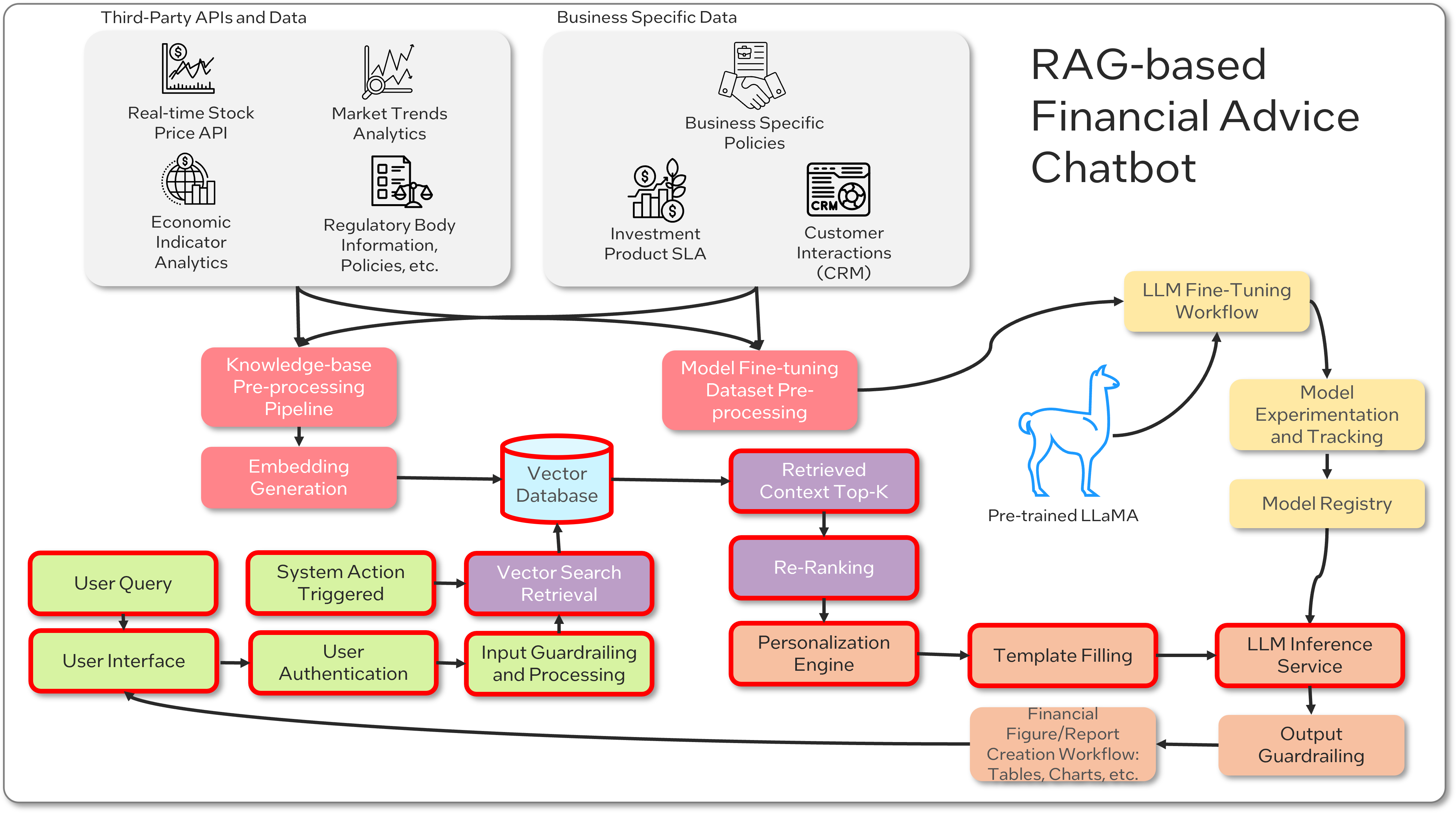

Tailor Advice with Advanced Data Processing

When a client interacts with the chatbot or a preconfigured alert triggers a system action, a customized process is initiated, which includes data retrieval, reranking, and personalization (see figure 4). This tailored approach ensures that the advice provided is not generic but specifically adapted to the client’s distinct financial situation and objectives.

Figure 4. Highlighting the advanced data processing layer of the solution architecture

Ensure Accuracy and Compliance

To maintain precision and adherence to regulations, the chatbot’s outputs are subjected to stringent guardrails and postprocessing (see figure 5). This step is critical in the financial sector where the cost of inaccuracies can be substantial.

Figure 5. Highlighting the accuracy and compliance layer of the solution architecture

The Role of Visual Aids and Reports in Financial Advice

Financial advice relies on both the precision of the data and the clarity of communication. To facilitate this, the chatbot includes a feature that generates financial figures and reports, such as tables, charts, plots, account statements, and other visualizations. These tools help clients better understand and visualize their financial standing and the guidance provided, ensuring that the advice is not only accurate but also comprehensible and engaging.

Figure 6. Highlighting the visual aids and reports layer of the solution architecture

Address Financial Goals with RAG

Let’s explore a sample scenario where a solution like this might create value for end users:

Alex and Sam (fictional personas) each have distinct financial challenges due to their differing income stability and goals. Alex grapples with the unpredictability of freelance photography income, and Sam seeks efficient pathways to early retirement. These goals could benefit from advice beyond the scope of a generic document. A RAG financial advice chatbot, with its ability to dynamically access and augment LLM responses using a vast array of financial data and regulations, could potentially help.

For Alex, the tool can retrieve and synthesize market trends and his sporadic earning statements to craft a flexible savings strategy, enabling his dream of global travel without hindering photography equipment investments.

Meanwhile, Sam could benefit from a tailored investment plan derived from the chatbot’s ability to retrieve and incorporate stock market stability and spending data. This ensures reliable recommendations for building a healthy stock portfolio and balanced budget—both aligned to his early retirement goals.

This approach, supported by RAG's data processing and retrieval capabilities, could help navigate the complexities of their financial aspirations, and prove to play a pivotal role in delivering much needed personalized financial advice.

Summary

The financial services industry is undergoing significant transformation, with the need for personalized and accurate financial advice rising. RAG-based chatbots offer a solution to tackle the challenge of providing timely, relevant, and customized financial advice. By using real-time access to current financial data and regulations, these chatbots demonstrate in-depth knowledge and continuous self-improvement, ensuring precision and compliance.

Next Steps

Register for free on the Intel® Tiber™ Developer Cloud, and then implement the RAG with LangChain code sample on Intel Tiber Developer Cloud using datasets ranging from robot maintenance to grocery store cashiers.

Also, you can access various code sample demos available in machine learning and generative AI domains. After signing in, to launch a free Jupyter environment, select Training and then Launch Jupyter. Try out these demos and run them on the latest Intel hardware such as Intel® Xeon® processors and Intel® Gaudi® accelerators.

We encourage you to also check out and incorporate Intel’s other AI and machine learning framework optimizations and end-to-end portfolio of tools into your AI workflow and learn about the unified, open, standards-based oneAPI programming model that forms the foundation of Intel® AI Software Portfolio to help you prepare, build, deploy, and scale your AI solutions.

AI Tools

Accelerate data science and AI pipelines—from preprocessing through machine learning—and provide interoperability for efficient model development.

You May Also Like

Related Articles